By Irma Johanna Mosquera Valderrama

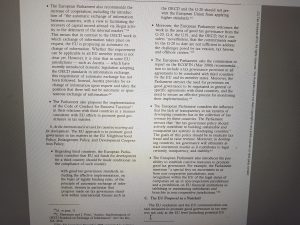

I am currently working on two papers on good governance in tax matters for EU countries and for non-EU (third) countries, and after doing a lot of reading on the topic, I just realized that I needed to go back to an article that I wrote in 2010, at the time that all developments of exchange of information started (Irma Johanna Mosquera Valderrama , EU and OECD Proposals for International Tax Cooperation: A New Road? Tax Notes International, Volume 59, Number 8 August 23, 2010). See picture below for the main elements of the 2010 Parliament Resolution as described in my 2010 article.

I also realized that it took almost 9 years for the EU to effectively enforce this standard of good tax governance with non-EU (third) countries (see 2009 Communication (COM(2009) 201 final) and 2010 Parliament Resolution (European Parliament Resolution, Feb. 10, 2010, on Promoting Good Governance in Tax Matters; P7 TA 2010 (0020)).

The actions that are currently in the spotlight are the list of non-cooperative tax jurisdictions (as of May 25, 2018 being reduced to 7 countries), the use of the code of conduct, and the introduction of a good tax governance clause in agreements concluded with third countries. These actions were already suggested in the EU Parliament Resolution of February 2010, so what is new in all this discussion of good governance in tax matters?

My view is that what is new is the political commitment of EU countries to these developments and their willingness to submit a list of countries as non-cooperative tax jurisdictions.

More to be presented: For non-EU (third) countries at the Jean Monnet Network ‘The European Union at the Crossroads of Global Order’ EUCROSS conference in Hong Kong June 2018: The EU and its Partners in Global Governance: Trade, Investment, Taxation and Sustainable Development.

For EU countries at the European Consortium for Political Research ECPR panel on Change and Stability in Global Tax Policy in Hamburg August 2018 for EU countries.